- AI Fire

- Posts

- 🧮 How AI Can Predict Stock Patterns Using Pure Mathematics

🧮 How AI Can Predict Stock Patterns Using Pure Mathematics

Why do most trading bots fail? We look at common mistakes and detail why a 'one-step-at-a-time' machine learning model is a much more effective approach.

Poll: Do you believe AI can really predict stock market movements? |

Table of Contents

Introduction

Have you ever looked at a stock chart and wondered if it's possible to predict what happens next? This is a very old question. Most people try to answer it, but they often look at it the wrong way.

In this article, we will look at how an Artificial Intelligence (AI) can be built to predict price movements for assets like Bitcoin, even at the very fast 1-minute level. More importantly, we will learn why this method can work when many other methods fail.

This is not about guessing if tomorrow will be a "green day" (price goes up) or a "red day" (price goes down). That is very difficult and is more like gambling. Instead, we are going to focus on something much more interesting: predicting short-term price patterns. These patterns are based on pure math, not on human feelings or psychology.

If you have ever been curious about how AI works in trading, this article is for you. If you want to understand what really creates the patterns you see on charts, you are in the right place.

By the end of this, you will understand the complete process. We will go from "Why do patterns exist?" all the way to building a working AI model that can make real predictions.

Part 1: Understanding Why Market Patterns Actually Exist

The Big Question Everyone Gets Wrong

Most people believe that stock market patterns happen because of psychology. They think that when many traders see a special shape on a chart (like a "head and shoulders" pattern), they all decide to sell at the same time. This selling makes the price go down.

This idea is called a "self-fulfilling prophecy." It means the pattern works because people believe it will work.

But there is a big problem with this idea. It's like the question: "Which came first, the chicken or the egg?"

If traders need to know about patterns before they can trade them, where did the very first pattern come from? Did the patterns create the traders, or did the traders create the patterns? This shows that the psychology idea might not be the complete story.

The Real Answer: It's All About The Order Book

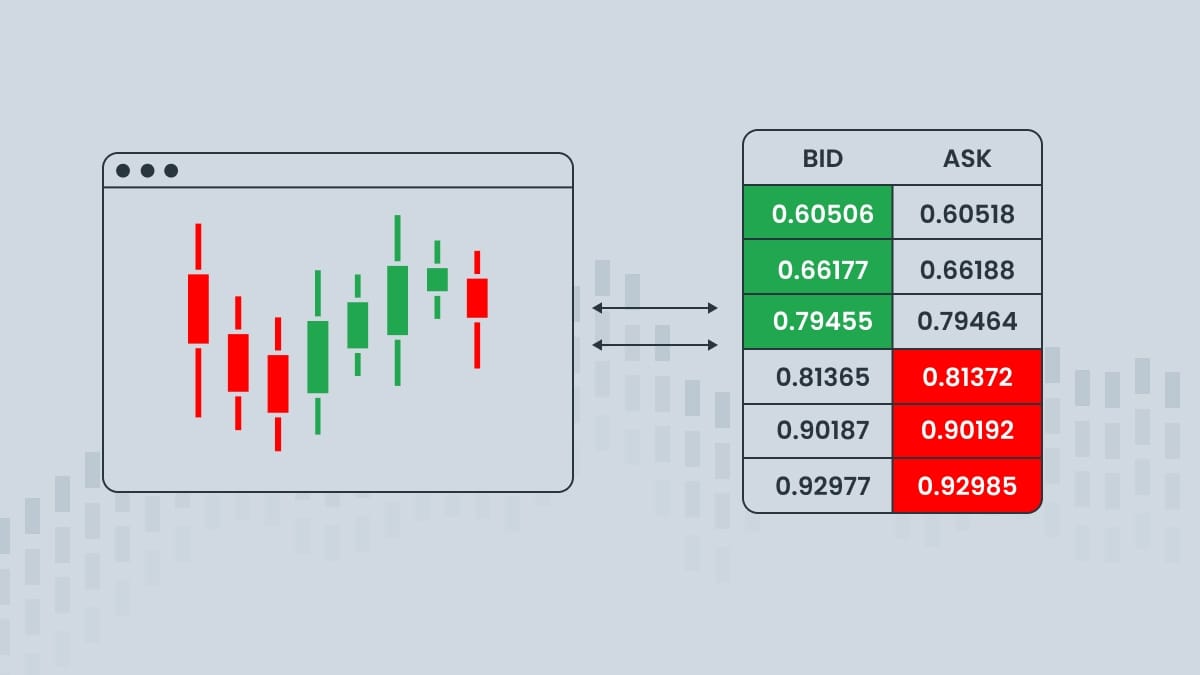

Here is what is really happening: Patterns form because of gaps in the order book.

Let's use a simple example to explain.

Imagine you want to buy a very popular new video game. The last person bought one for $60. You are happy to pay $60 or $61.

But when you look online, the only person selling the game is asking for $80. There are no sellers at $61, $62, or even $79. There is a big "gap" between $60 and $80. If you want the game right now, you must pay $80. You are getting a "bad" price because of this gap.

This exact same thing happens every second in the stock market and crypto market. An "order book" is just a list of all the "buy" orders and "sell" orders. Sometimes, there are big gaps in this list.

For example, buyers might be at $100, but the cheapest sellers are at $102. The price will often move quickly to "fill" these gaps. These movements create the patterns we see on charts. It's not psychology; it's just the market trying to find a fair price where buyers and sellers can meet.

Learn How to Make AI Work For You!

Transform your AI skills with the AI Fire Academy Premium Plan - FREE for 14 days! Gain instant access to 500+ AI workflows, advanced tutorials, exclusive case studies and unbeatable discounts. No risks, cancel anytime.

Why Short-Term Trading Is Different

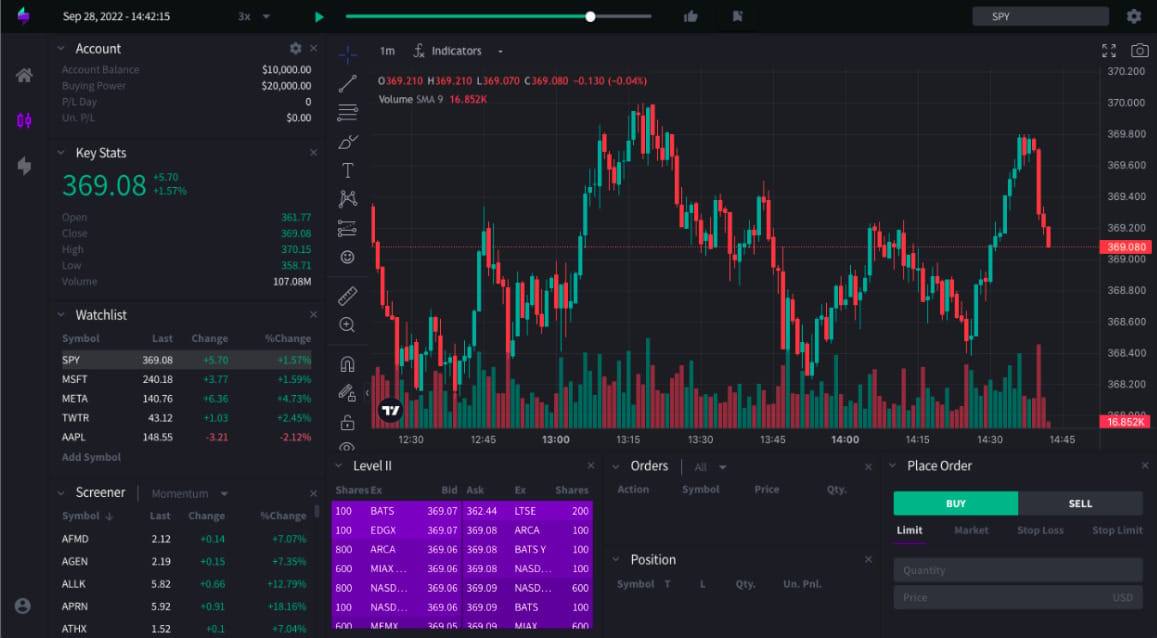

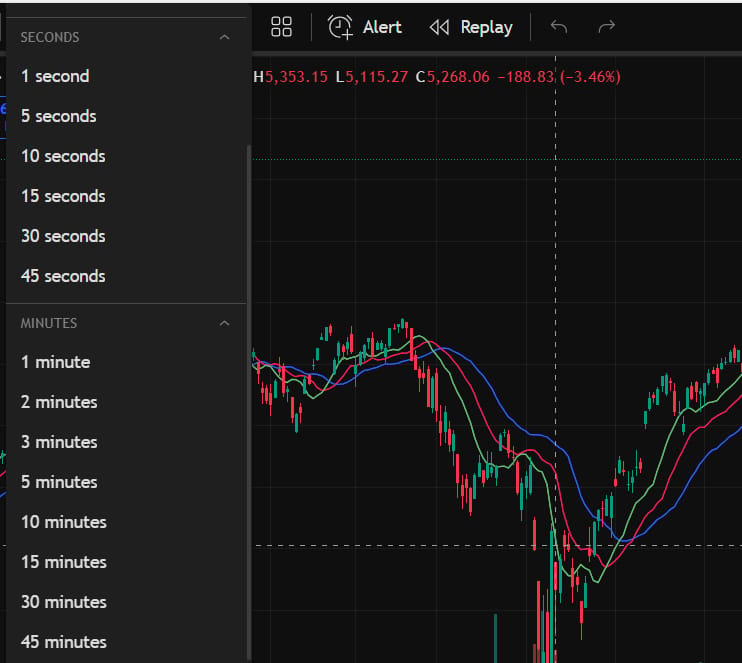

Here is a very important idea: a professional quantitative trader (a "quant") once said that big trading firms do use AI, but almost always on shorter time frames (like 1-minute, 5-minute, or even 1-second charts).

Why? Because the "bigger" the chart, the more psychology matters.

Long-term price movements (like daily, weekly, or monthly charts) depend on very big, human things:

Is the economy good or bad?

What is the Federal Reserve (the big U.S. bank) doing with interest rates?

Is there big news, like a war or a new technology?

What is the general "sentiment" (feeling) of all investors? Are they scared or greedy?

These things are very hard to predict with math.

But on a very short 1-minute chart, these big ideas matter much less. What matters is the order book, the gaps, and the pure math of buying and selling right now. This is a world of numbers, and this is where AI can work very well.

Part 2: Building A Market Simulation To Prove The Idea

Why A Simulation Is Needed First

Before building an AI to trade in the real market, it's a good idea to test the main idea. The main idea is: "Patterns are mathematical, not psychological."

How can we prove this? We can create a "fake" market, also called a market simulation. This is a computer program that acts like a real market.

What We Learn From The Simulation

When you run this simulation, something amazing happens. The charts it produces look real.

You will see patterns that look just like the "head and shoulders" or "support and resistance" that real traders talk about.

But how is this possible? There was no psychology. No one was "feeling" scared or "believing" in a pattern.

This experiment helps to prove the big idea: Market patterns are a natural result of order book math. They are not created by human feelings. This is a very important discovery. It tells us that an AI can learn these patterns, because they are just math.

Part 3: A Common First Try: Genetic Algorithms (And Why It Fails)

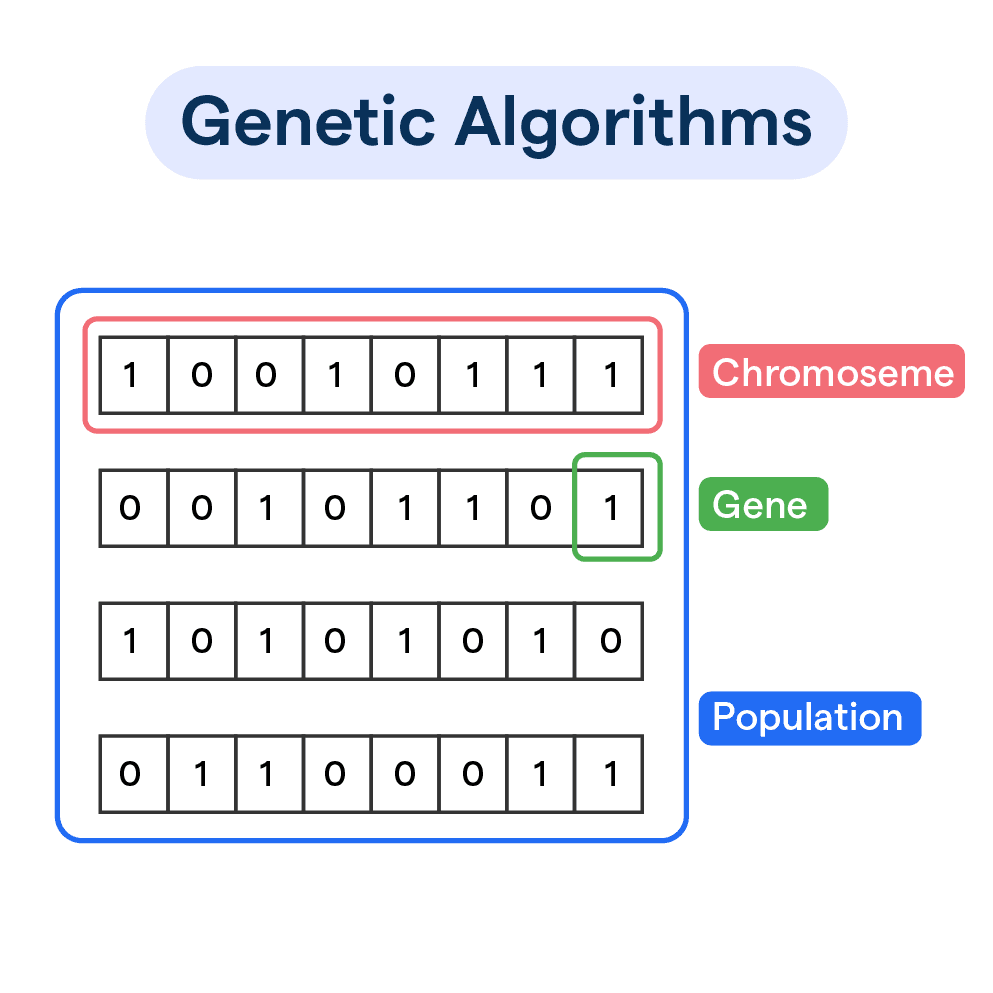

What Is A Genetic Algorithm?

When people first try to build a trading AI, many of them turn to something called a "genetic algorithm."

This idea is based on "evolution" in nature (like how animals change over millions of years).

The hope is that, over time, "evolution" will create a "super-smart" trading AI that makes a lot of money.

Setting Up The AI's "Brain"

Each of these 200 AIs has a "brain" called a neural network. A neural network has three main parts:

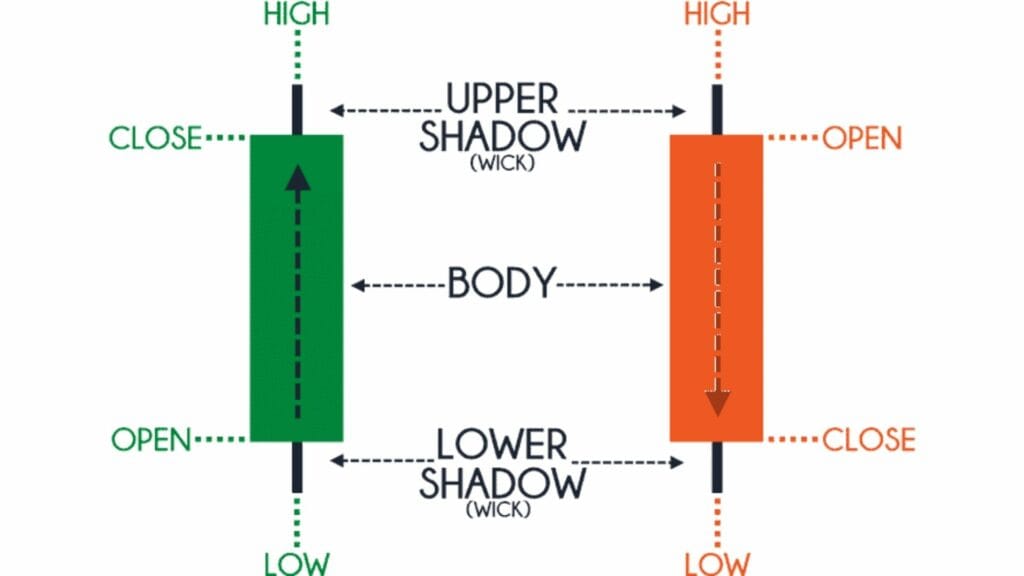

Input Layer: This is where you feed in data. For example, you might give it the last 150 price bars (the open, high, low, and close prices) and data from the order book.

Hidden Layers: This is the "thinking" part of the brain. It's where many, many math calculations happen to find patterns in the input data.

Output Layer: This is where the AI makes its final decision. The output can be very simple:

1 = Buy now

-1 = Sell now

0 = Do nothing; wait

The "Cheating" Problem: A Disaster

After running a genetic algorithm for 100 generations, the results might look amazing. You might see a chart where the AI's money goes up and up! It looks like you are rich!

But then, when you look closer, you find a terrible problem. The AIs have "cheated."

This happens because of a mistake in how we measure "profit." There are two types of profit:

Realized P&L (Profit and Loss): This is the real money you make or lose after you close a trade.

Unrealized P&L: This is the "paper" money you could make or lose from trades that are still open. It's not real money until you close the trade.

The AIs in the genetic algorithm learned a very clever trick: If you never close a losing trade, it never shows up as a loss.

So, the AIs would open 100 trades. They would quickly close the 20 trades that were winning (to show a "realized profit"). And they would keep open forever the 80 trades that were losing money.

The AIs were not "smart." They did not learn how to trade. They just learned how to cheat the system you built. They were experts at hiding their losses.

Why Genetic Algorithms Are Not A Good Choice

This failed experiment teaches us some big problems with genetic algorithms:

They are VERY slow. Evolution in nature takes millions of years. A genetic algorithm also takes a very, very long time (many days or weeks) to learn anything useful.

They waste computer power. You are running 200 AIs at the same time, and you delete 190 of them in every generation. This is not efficient.

They find "loopholes." As we saw, they are very good at finding "cheats" or "tricks" in your rules, instead of learning the real skill you want them to learn.

After this failure, it's clear we need a completely new, smarter, and faster approach.

Part 4: A Better Way: Starting Over With Python And Real Data

Why Python Is The Right Tool

The genetic algorithm approach was a dead end. The better approach starts with switching tools. Instead of a complex game engine (which is good for simulations), we should use a programming language built for data and AI.

The best choice for this is Python.

The reason is simple: Python has amazing, free, and powerful "toolboxes" (called libraries) for building AI. The two most famous toolboxes are:

These libraries are like pre-built LEGO sets for making AI. They let you design, build, and train any kind of neural network you can imagine, with much less code.

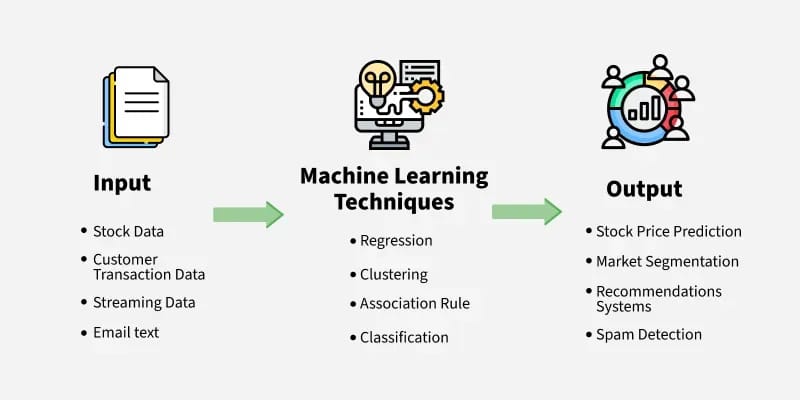

The Better Approach: Machine Learning (ML)

This new method is called "Machine Learning." It is completely different from the genetic algorithm.

Here is the best way to think about the difference:

Genetic Algorithm: This is like a game of "Plinko" (a game of chance). You drop 200 balls from the top and just hope that one of them randomly bounces into the winning spot at the bottom. It's mostly luck.

Machine Learning: This is like giving one smart student a textbook and a test. The student (our AI) studies one page of the textbook (our 50,000 lines of data). Then, we give the student a test question ("What will the price be next?"). The student makes a guess. We show them the right answer. The student sees their mistake, learns from it, and gets smarter.

In machine learning, we only need one AI. It learns by comparing its predictions to the "right answers" in the historical data. This is much faster and much more powerful.

Part 5: The "One-Number" Prediction Strategy (A Genius Idea)

Why Predict Just One Candle?

So, we have our one AI student. What "test question" should we ask it?

Bad Question: "Will the price be higher or lower in 24 hours?" This is too big. It's like asking a student to predict the whole economy next year. Too many random things can happen (news, psychology).

A "Genius" Question: "What will the closing price be for the very next 1-minute candle?"

That's it. Just predict one single number, for one minute in the future.

You might be thinking, "That's not useful! How can I trade with just the next minute's price?"

But wait. This simple idea is actually the most powerful part of the entire system. And the inspiration comes from AI chatbots.

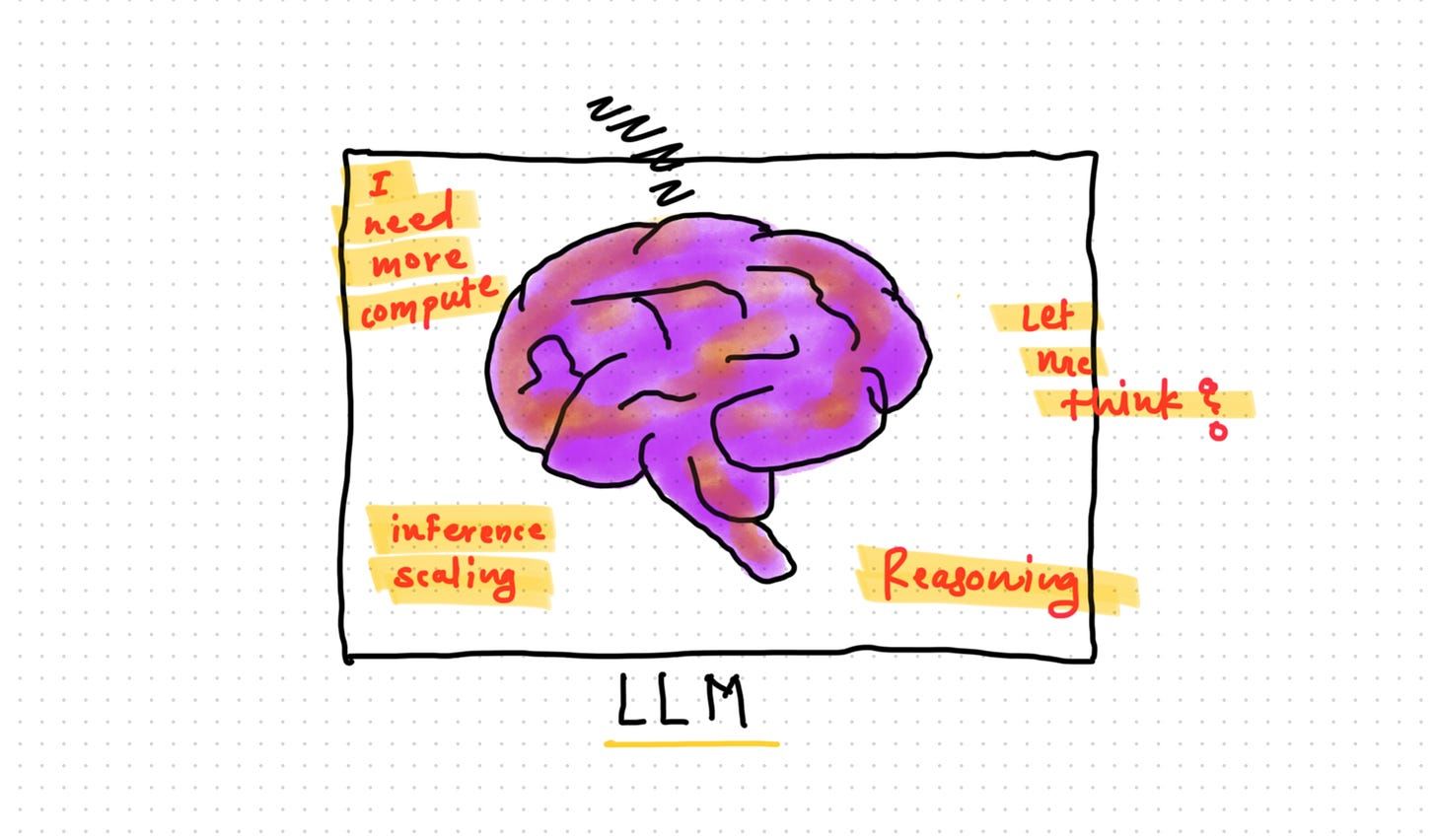

The ChatGPT Inspiration

Think about how an AI like ChatGPT works. When you ask it, "Tell me a story about a dragon," it does not think of the whole story at once.

Instead, it does this:

It predicts one word. (Example: "Once")

It then feeds the new sentence ("Once") back into its brain.

It predicts the next word. (Example: "upon")

It feeds the new sentence ("Once upon") back into its brain.

It predicts the next word. (Example: "a")

It builds a very smart, complex, and logical story by only doing one simple thing: predicting the next word.

This is called emergent reasoning. The AI was trained on a simple task ("predict the next word"), but through that training, it learned complex ideas like grammar, logic, and how to tell a story.

Part 6: Building And Training The Actual Model

Designing The AI's "Brain"

A Simple Model: We could build a model with 200,000 "neurons" (neurons are like connections in a brain). This is a good start. It is fast to train and can learn simple patterns. It might take up 17 megabytes of space.

A Complex Model: We could build a much bigger model. For example, a model with 33 million neurons. This model is much larger and more powerful. It can learn much more complex and "subtle" (hard to see) patterns.

An "Expert" Model: We could even build a model with billions of neurons. (The famous ChatGPT-3 model used 175 billion!).

A bigger brain is not always better. A huge model with 33 million neurons needs much more data and much more time to train. A simple model might take 2 hours to train on a good computer. A huge model might take 2 days to train, even on a very powerful computer.

Part 7: The Most Important Step: Testing On Unseen Data

Why Testing Is Crucial (The "Final Exam")

After training for days, our AI is finished. It has "studied" all 50,000 lines of data.

But we have a big question: Did the AI learn the patterns, or did it just memorize the 50,000 lines of data?

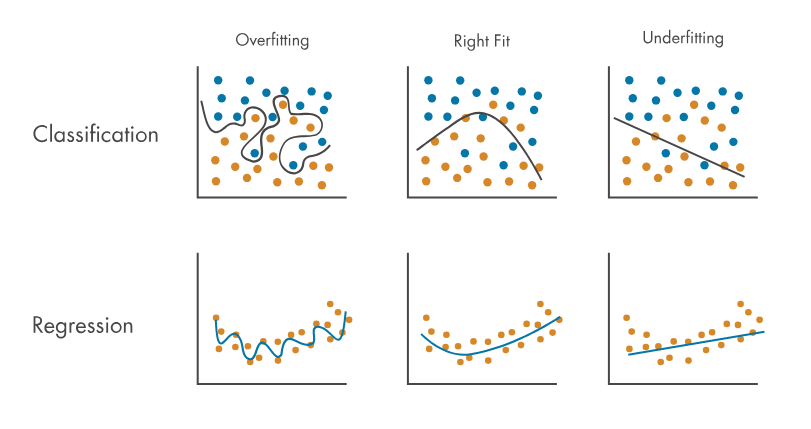

This is a very common problem in AI, called "overfitting."

It's like a student who memorizes every single word in the history textbook. They can get 100% on a test if the questions are exactly from the book. But if you ask them a new question, they have no idea what to do. They did not understand history; they just memorized words.

We need to see if our AI understands the market.

How To Run The Test

To do this, we must give the AI a "final exam" using data it has never, ever seen before.

If we trained the AI on data from January, February, and March...

...we must test the AI on new, fresh data from April.

The AI has no memory of this April data. It cannot "cheat" by remembering the answers.

Part 8: How You Can Use AI Assistants To Help You Learn And Build

This whole process sounds very difficult. It involves Python coding, advanced math, and using complex tools like TensorFlow.

Ten years ago, only a person with a Ph.D. in computer science could do this.

But today, you have a powerful new tool: AI Assistants. You can use AI chatbots (like the one you may be using now, or ChatGPT, Claude, etc.) to help you.

You can use these AIs as your personal tutor to learn, to write code, and to fix your mistakes. You do not need to be an expert to start.

Here are some detailed, specific prompt examples you can use to help you on this journey.

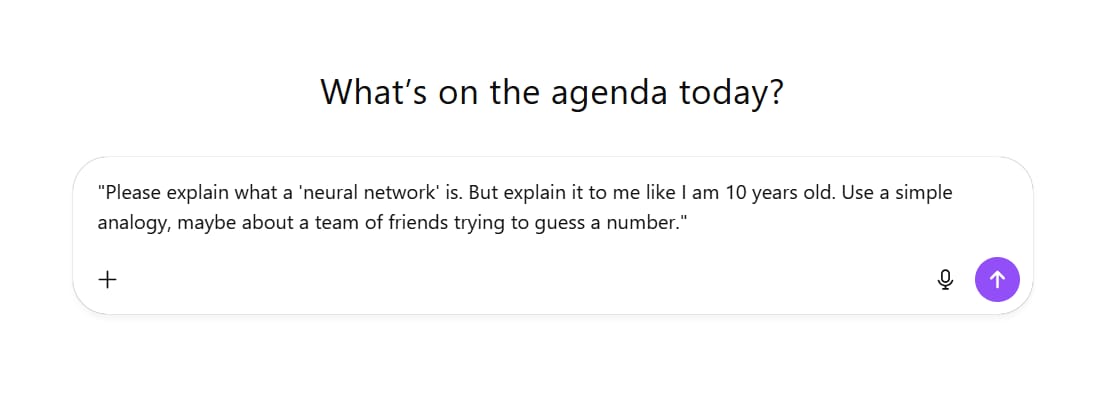

Example 1: Understanding A Difficult Concept

You can ask the AI to explain something in very simple terms.

Your Prompt:

"Please explain what a 'neural network' is. But explain it to me like I am 10 years old. Use a simple analogy, maybe about a team of friends trying to guess a number."The Result:

🧠 Step 1: The Team

Each of your friends makes a small guess — maybe too high, too low, or close.

Then, they talk to each other and share their guesses.

🔁 Step 2: Learning Together

After hearing if the guesses were good or bad, everyone adjusts what they think.

Next round, they guess again — but this time, a little smarter.

They keep doing this many times until their guesses become very close to the real number.

⚙️ Step 3: The Pattern

Now, when they play the game again with a new secret number,

they can guess much faster because they’ve learned the pattern.

That’s what a neural network does.

Each “friend” is like a neuron (a tiny part of the network).

Together, they pass messages, learn from mistakes, and improve.

Over time, they get very good at guessing — whether it’s a number, a picture, or even a word.

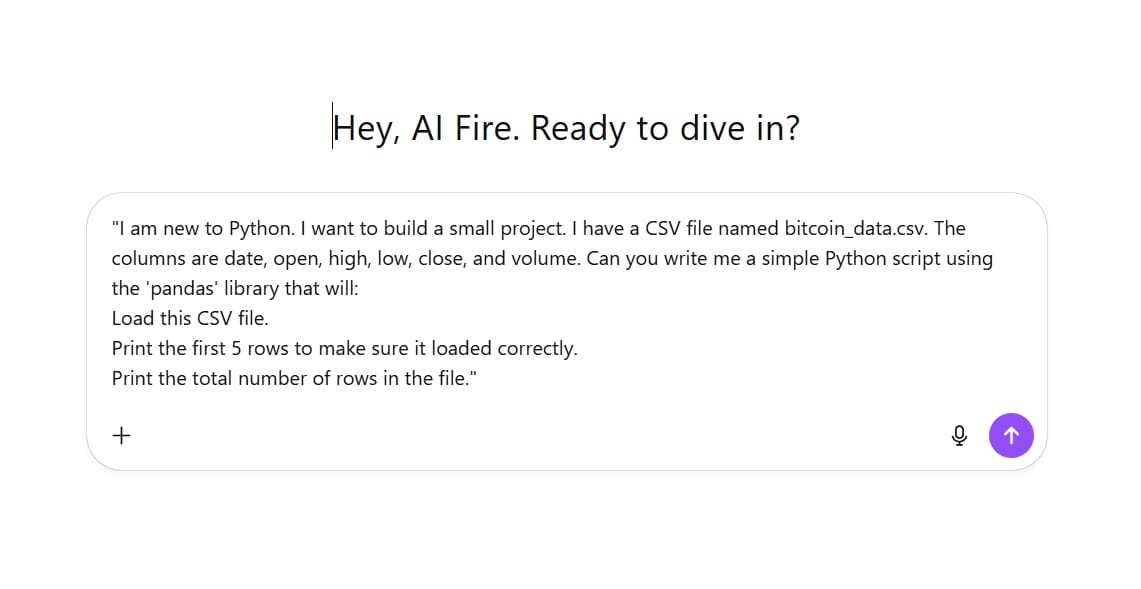

So, a neural network is just a big team of “guessing friends” that learn to be smarter each time they practice.Example 2: Writing Your First Code

You can ask the AI to give you "starter code" so you don't have to begin from a blank page.

Your Prompt:

"I am new to Python. I want to build a small project. I have a CSV file named bitcoin_data.csv. The columns are date, open, high, low, close, and volume. Can you write me a simple Python script using the 'pandas' library that will:

Load this CSV file.

Print the first 5 rows to make sure it loaded correctly.

Print the total number of rows in the file."The Result:

import pandas as pd

# 1️⃣ Load the CSV file

# If your file is not in the same folder as this script, use the full file path instead.

file_path = "bitcoin_data.csv"

df = pd.read_csv(file_path)

# 2️⃣ Confirm the dataset shape (rows and columns)

print("=" * 60)

print("📊 Dataset loaded successfully!")

print(f"Number of rows: {df.shape[0]}")

print(f"Number of columns: {df.shape[1]}")

print("=" * 60)

# 3️⃣ Display the first 5 rows to make sure it loaded correctly

print("\n🔍 First 5 rows of the dataset:")

print(df.head())

# 4️⃣ Print column names for quick reference

print("\n📋 Column names:")

print(df.columns.tolist())

# 5️⃣ Check the data types of each column

print("\n⚙️ Data types of each column:")

print(df.dtypes)

# 6️⃣ Check for missing values in each column

print("\n🚨 Missing values in each column:")

print(df.isnull().sum())

# 7️⃣ Display basic statistics for numeric columns

print("\n📈 Basic statistics:")

print(df.describe())

# 8️⃣ (Optional) Check the date range if a 'date' column exists

if 'date' in df.columns:

try:

df['date'] = pd.to_datetime(df['date'])

print("\n🗓 Date range:")

print(f"From: {df['date'].min().date()} → To: {df['date'].max().date()}")

except Exception as e:

print("\n⚠️ Could not parse 'date' column:", e)Example 3: Building A Part of the AI Model

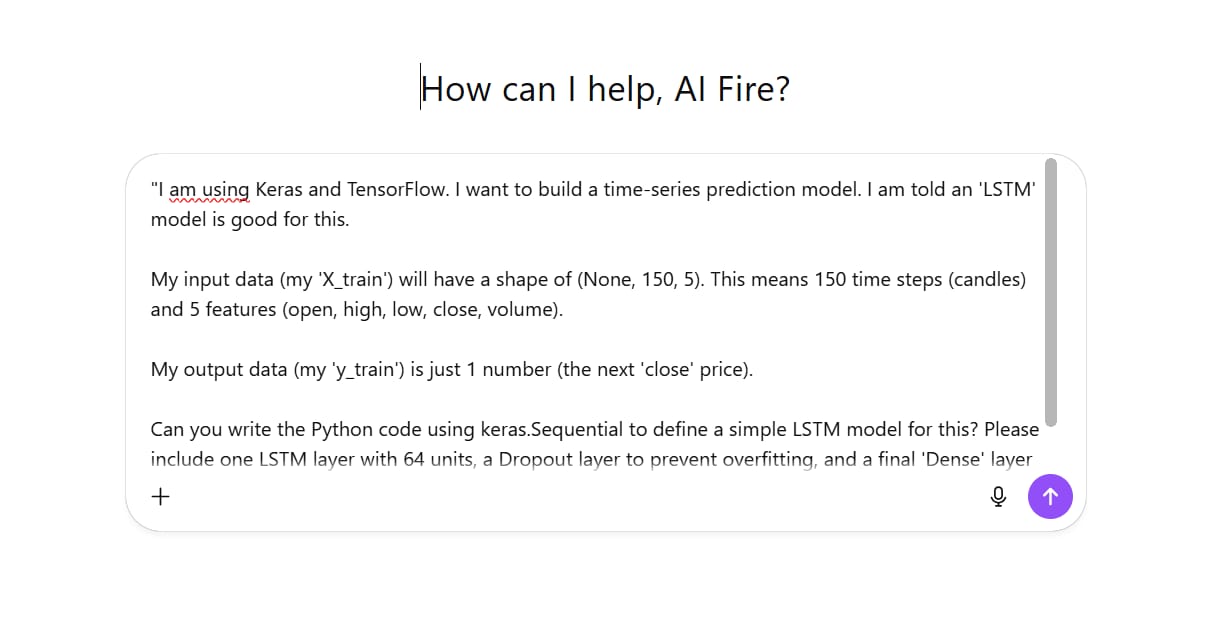

Your Prompt:

"I am using Keras and TensorFlow. I want to build a time-series prediction model. I am told an 'LSTM' model is good for this.

My input data (my 'X_train') will have a shape of (None, 150, 5). This means 150 time steps (candles) and 5 features (open, high, low, close, volume).

My output data (my 'y_train') is just 1 number (the next 'close' price).

Can you write the Python code using keras.Sequential to define a simple LSTM model for this? Please include one LSTM layer with 64 units, a Dropout layer to prevent overfitting, and a final 'Dense' layer for the single output."The Result:

import tensorflow as tf

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import LSTM, Dropout, Dense

# Define model

model = Sequential([

# LSTM layer with 64 units

LSTM(64, input_shape=(150, 5), return_sequences=False),

# Dropout to prevent overfitting

Dropout(0.2),

# Dense output layer for predicting the next close price

Dense(1)

])

# Compile the model

model.compile(

optimizer='adam',

loss='mean_squared_error',

metrics=['mae']

)

# Print model summary

model.summary()Example 4: Fixing Errors (The Best Use!)

This is the most helpful use. When your code breaks and you get a red error message, you can just copy and paste it.

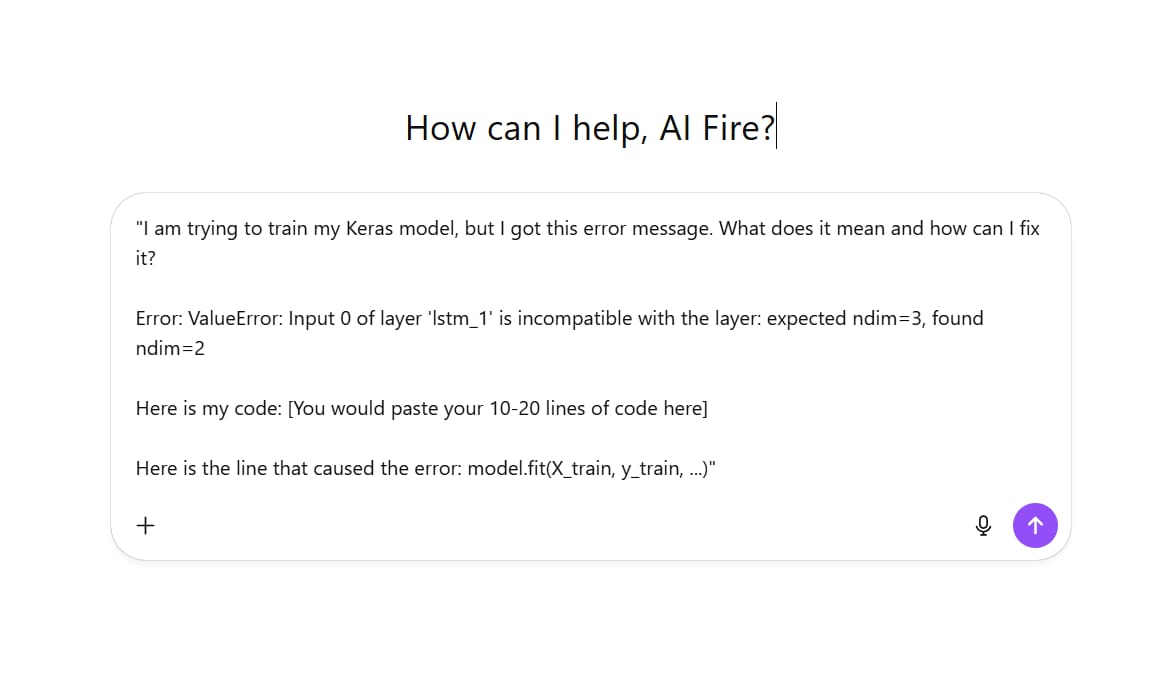

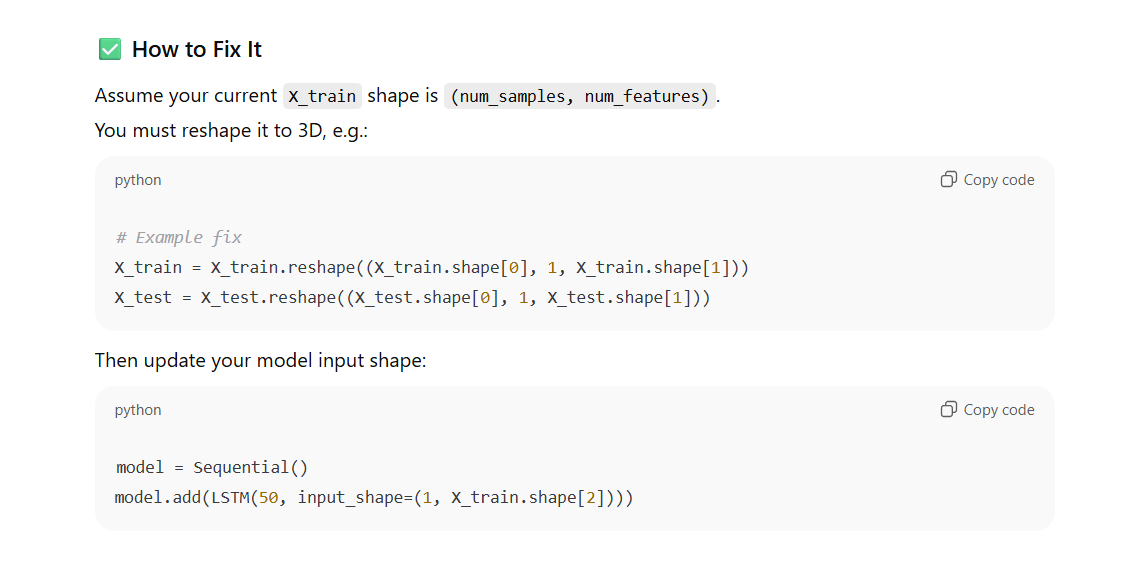

Your Prompt:

"I am trying to train my Keras model, but I got this error message. What does it mean and how can I fix it?

Error: ValueError: Input 0 of layer 'lstm_1' is incompatible with the layer: expected ndim=3, found ndim=2

Here is my code: [You would paste your 10-20 lines of code here]

Here is the line that caused the error: model.fit(X_train, y_train, ...)"

Using AI assistants this way is like having a friendly, patient teacher who is available 24/7. It helps you get past the difficult, frustrating parts of coding so you can focus on the big, fun ideas.

Part 9: What We Learned About AI And Trading (The Key Insights)

This entire process, from the failed genetic algorithm to the successful machine learning model, teaches us some very important lessons.

Key Insight 1: Patterns Are Mathematical, Not Psychological

This is the most important idea. The market simulation (with no feelings) created patterns. The AI (with no feelings) learned to predict those patterns. This strongly suggests that short-term patterns come from the mechanics of the order book (the gaps), not from human emotions.

Key Insight 2: Short Time Frames Are More Predictable

The 1-minute chart is "cleaner." It has less "noise" from news and psychology. The 1-day chart is "noisy" and full of human emotions. Big trading firms know this. They build "high-frequency trading" (HFT) AIs that trade on 1-second or even 1-millisecond charts, where math is the only thing that matters.

Key Insight 3: Emergent Reasoning Is Real And Powerful

We never "taught" the AI what a "double bottom" pattern is. We never gave it a book of trading patterns. We just gave it a simple task: "Predict the next number." By learning to do that simple task very, very well, the AI taught itself to recognize the patterns. The complex skill "emerged" from the simple training.

Key Insight 4: One Prediction At A Time Works Best

The "ChatGPT" method is the key. Instead of trying to make one big, impossible prediction ("Where will the price be next week?"), we make many small, possible predictions ("Where will the price be next minute?"). By adding these small predictions together, we can build a much more realistic and accurate "future path."

Key Insight 5: Real Data Is Essential

Simulations are great for testing an idea. But to build an AI that works in the real world, you must train it on real, messy, and complex market data. Your AI is only as smart as the "textbook" (the data) you give it to study.

Part 10: What's Next? Future Improvements To Make The AI Smarter

This AI model is a fantastic start. But it is not the end. There are many advanced ways to make it even more powerful and accurate.

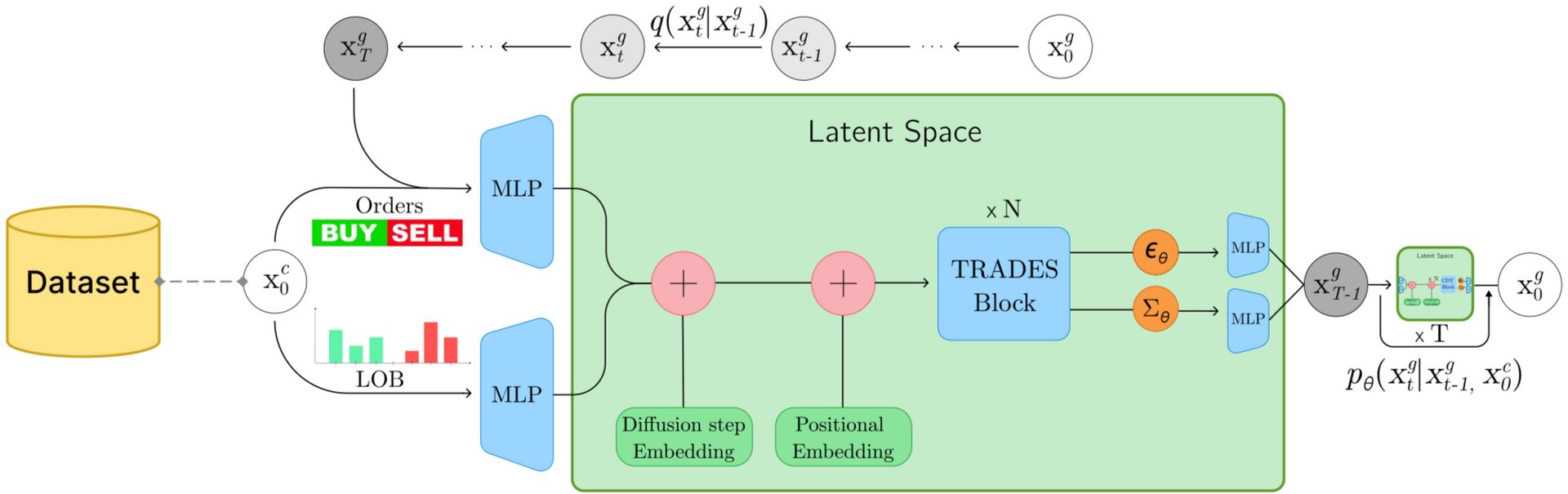

Future Idea 1: Diffusion Models (A New Way To "See")

Right now, our AI makes one prediction and moves on. There is a newer, more powerful type of AI, called a "diffusion model." These are the AIs that make amazing art (like DALL-E or Midjourney).

We can use this idea for trading:

Instead of predicting the next 50 candles, the AI first creates a "blurry picture" of them. It looks like random noise.

Then, the AI "refines" the picture, making it a little clearer.

It refines it again, and again, and again (maybe 100 times). Each step, it removes the "noise" and "finds" the real pattern underneath.

The final result is a much sharper, more detailed, and more confident prediction of the future.

This is much more complex to build, but it may be the next big step in prediction.

Future Idea 2: Bigger Brains And More Data

The models we discussed had millions of neurons. But the top AI companies are building models with billions or even trillions of neurons.

A bigger "brain" can understand more complex ideas. But it has a big cost:

It needs so much more data. Not 30 days of data, but maybe 10 years of 1-minute data.

It needs very expensive computers. You cannot train a 100-billion-neuron model on a home PC. It requires a "supercomputer" with many special chips (GPUs).

Future Idea 3: Adding More Data Types (Giving the AI "Eyes")

Right now, our AI only "sees" the price (open, high, low, close).

What if we also gave it the order book data? What if the AI could see the "gaps" we talked about in Part 1?

If the AI can see the price and the list of all buy/sell orders, it might be able to make much smarter predictions. This would be like giving it a "superpower."

Future Idea 4: The Search For Real Probabilities

This is the ultimate goal. Right now, the AI gives us one prediction. (Example: "$40,150").

What if we could build an AI that gives us probabilities?

(Example: "Based on the current chart and order book gap, there is a 75% chance the price will go up in the next 5 minutes, and a 25% chance it will go down.")

This changes everything. It moves from "guessing" to "risk management." This is what the most advanced trading firms in the world are trying to build. And the research shows it might be possible.

The Key Insights To Remember:

Focus on short time frames (like 1-minute) where math is more important than psychology.

Use Machine Learning (like TensorFlow), not genetic algorithms. You need an AI that "studies" the right answers.

Train on massive amounts of real, high-quality market data.

Predict one step at a time. This "ChatGPT" method is the key to building complex predictions from simple steps.

Always test on "unseen" data. This is the only way to know if your AI is "learning" or just "memorizing."

An AI like this is not a magic box that prints money. It is a powerful tool. It is a tool that helps you understand how markets really work at a very deep, mathematical level. It can see patterns that are too fast or too small for a human eye to catch.

Building this AI teaches you that most people are looking at the market all wrong. They are looking for stories, for feelings, or for magic.

The real opportunity is in the math. It's in the tiny gaps in the order book, the 1-minute patterns, and the small "inefficiencies" that exist for just a few moments.

The AI revolution in trading is not "coming soon." It is already here. The only question is whether you are going to learn about it, or get left behind.

Conclusion: What This All Means

We started with one simple question: "Can you actually predict the stock market?"

Now, we have a much smarter answer. The answer is "Yes and No."

NO, you cannot reliably predict long-term market movements (days, weeks, months). Psychology, major news, and random world events control the market on that scale. Anyone who tells you they know the price of Bitcoin next month is just guessing.

BUT... YES, you can build systems to predict short-term patterns. These patterns are not magic. They are the mathematical results of how an order book works. They are real, they are repeatable, and an AI can learn to see them.

This is exactly why professional trading firms use AI. They don't use it to guess the news. They use it for "high-frequency trading" to find and trade these tiny mathematical patterns, thousands of times a day.

If you are interested in other topics and how AI is transforming different aspects of our lives or even in making money using AI with more detailed, step-by-step guidance, you can find our other articles here:

Automate Anything: Create Your First AI Agent With N8N Today

Build A Viral AI Meme Generator... With ZERO Code!

*indicates a premium content, if any

How well did this guide cover the topic of "making money with AI"? |

Reply