- AI Fire

- Posts

- 💥 Warning: The AI Bubble Burst Could Bankrupt Elon Musk

💥 Warning: The AI Bubble Burst Could Bankrupt Elon Musk

Don't be fooled by car sales. Musk's empire is a financial house of cards, and the AI bubble burst is about to trigger a $94B margin call

🏛️ What is the True Foundation of Musk's Empire?His companies (Tesla, xAI, SpaceX) seem unstoppable. What is the single, most critical pillar holding it all up? |

|

Table of Contents

The AI Bubble's Ticking Time Bomb: How Musk's Empire Could Collapse

At first glance, you might think Elon Musk is perfectly positioned to win when the AI bubble bursts. After all, Tesla funds its AI development with real car sales, not just borrowed billions like OpenAI or Anthropic. It looks like a stable, safe model.

But I've spent a lot of time digging into the public filings, the funding rounds and the interconnected web of his companies. When I did, I saw a very different and much more dangerous picture.

It looks to me like Musk's entire empire, Tesla, xAI and SpaceX, is a financial house of cards. The individual companies might look strong on their own but they are all leaning on each other. This setup has created a single, critical point of failure and that failure point is the AI bubble.

This guide breaks down my complete analysis. I'll show you the real vulnerabilities and explain why the coming AI collapse won't strengthen Musk's position, as so many assume. Instead, it could trigger a devastating chain reaction that destroys his entire empire. This is the part nobody is talking about and it's hiding in plain sight.

I. The Premise: What an "AI Bubble Burst" Actually Looks Like

Before we get into the companies, we need to be on the same page. When I say "AI bubble burst", I'm not talking about a 10% stock market dip or a mild "AI Winter".

I'm talking about a full-scale, market-altering disaster. To understand the threat to Musk, we have to establish what this scenario would actually look like. Based on my analysis, here’s what I believe we’re looking at.

1. The Stock Massacre

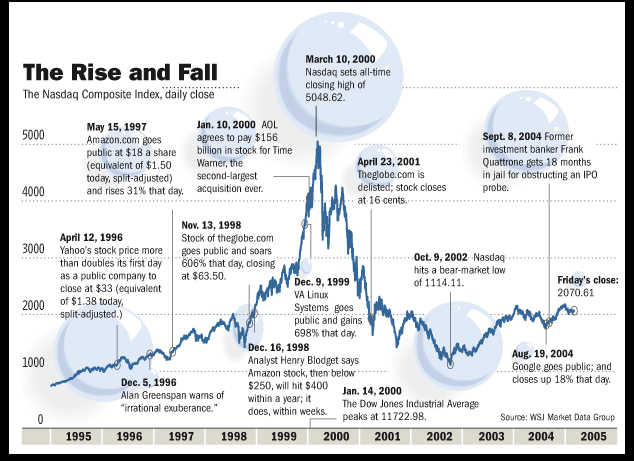

This is the most obvious part. Similar to the dot-com bubble of 2000-2001, the valuations of all companies associated with AI will crash as markets realize these businesses can't deliver on their overhyped promises.

Remember Amazon? A real, legitimate company that survived and now dominates the world still lost 90% of its value in that crash. I'm expecting similar, if not worse, devastation for companies that are currently propped up only by an "AI premium" rather than real profits.

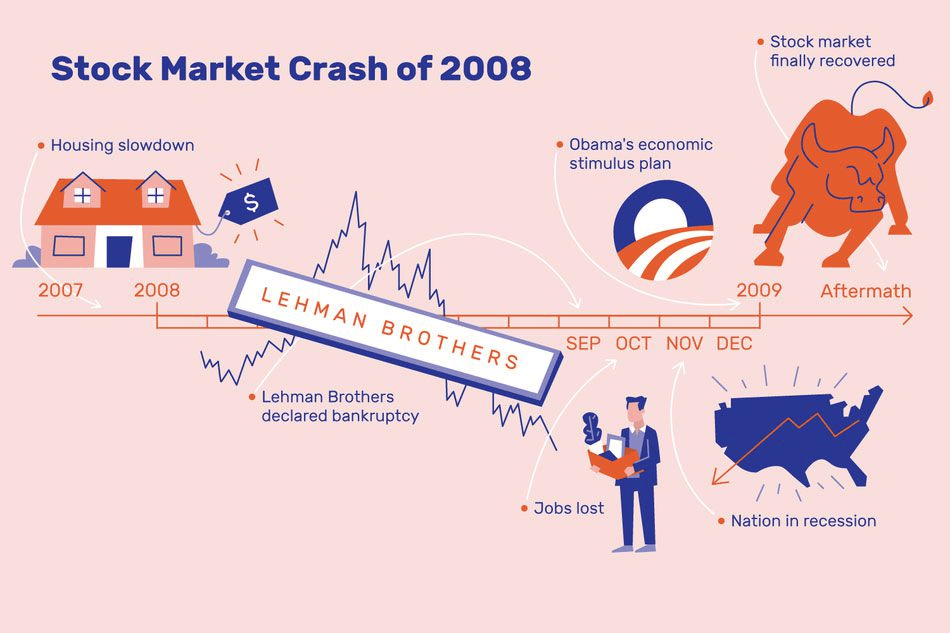

2. The 2008-Style Debt Crisis

This is the part that's far more dangerous than the dot-com bubble. Today's AI industry isn't just built on stock speculation; it's built on massive debt. We're seeing over $1.2 trillion in "AAA-rated" bonds tied to AI company debt. These are being sold to pension funds and investors as "safe" investments.

But the companies borrowing this money (the AI labs) have no profits. They are burning cash at an astonishing rate. This is the exact same structure as the 2008 subprime mortgage crisis, where toxic, high-risk debt was bundled up and sold as "safe".

The scary part? The 2008 crisis took nearly a decade to build up $1.9 trillion in bad debt. The AI industry hit $1.2 trillion in just two years. When these bonds inevitably default, it won't just be a stock crash; it will trigger a full-blown financial meltdown.

3. The Great Capital Freeze

This is the combined effect of the first two points. Venture capital, institutional investment and all forms of lending will contract severely or just plain vanish. After getting burned twice, a dot-com-style stock massacre and a 2008-style debt crisis, financial institutions will eliminate all speculative investments from their portfolios.

Money will only flow to guaranteed, profitable, low-risk businesses. Speculative R&D, the very lifeblood of Musk's ventures, will be dead on arrival.

4. The Failed Products (The Core Assumption)

Finally, this entire analysis assumes that Musk's key AI-driven projects( Optimus robots, Full Self-Driving (FSD), Robotaxis, Grok and even the Starship rocket) are all built on promises they can't actually deliver in the short term. They lack the basic skills to succeed in a world that is suddenly out of "easy money". They are "works in progress" that will run out of time and cash.

So, that's our scenario: a devastating stock market crash, a crippling debt crisis and a total freeze in speculative funding when the AI bubble bursts.

Now, let's apply that cold, hard reality to each piece of Musk's empire.

Learn How to Make AI Work For You!

Transform your AI skills with the AI Fire Academy Premium Plan - FREE for 14 days! Gain instant access to 500+ AI workflows, advanced tutorials, exclusive case studies and unbeatable discounts. No risks, cancel anytime.

II. xAI: The Vanity Project That Can't Survive Alone

Let's start with xAI. From my perspective, this company seems to exist for one primary reason: Musk's wounded ego after he failed to get total control of OpenAI, the company he co-founded. He wanted his own "AI toy" to play with and xAI is the result.

Right now, it's essentially OpenAI's less impressive cousin. It's a few years behind in capabilities and is primarily training on Twitter (now X) data. (Though, to be fair, OpenAI scrapes everyone's data, so this isn't a massive difference).

1. The Fundamental Problem: Diminishing Returns

Like all AI-native companies, xAI faces a huge challenge: their models aren't good enough yet to deliver the revolutionary productivity gains or automation capabilities they promise.

More importantly, these models are showing dramatically diminishing returns. You can't just throw 10x more money at them and expect them to be 10x smarter. The performance gains are getting smaller and smaller, while the costs for training are getting exponentially larger. This is a terrible business model in a world with free-flowing cash. In a world without it, it's a death sentence.

2. The Funding Reality Check: Who Really Pays?

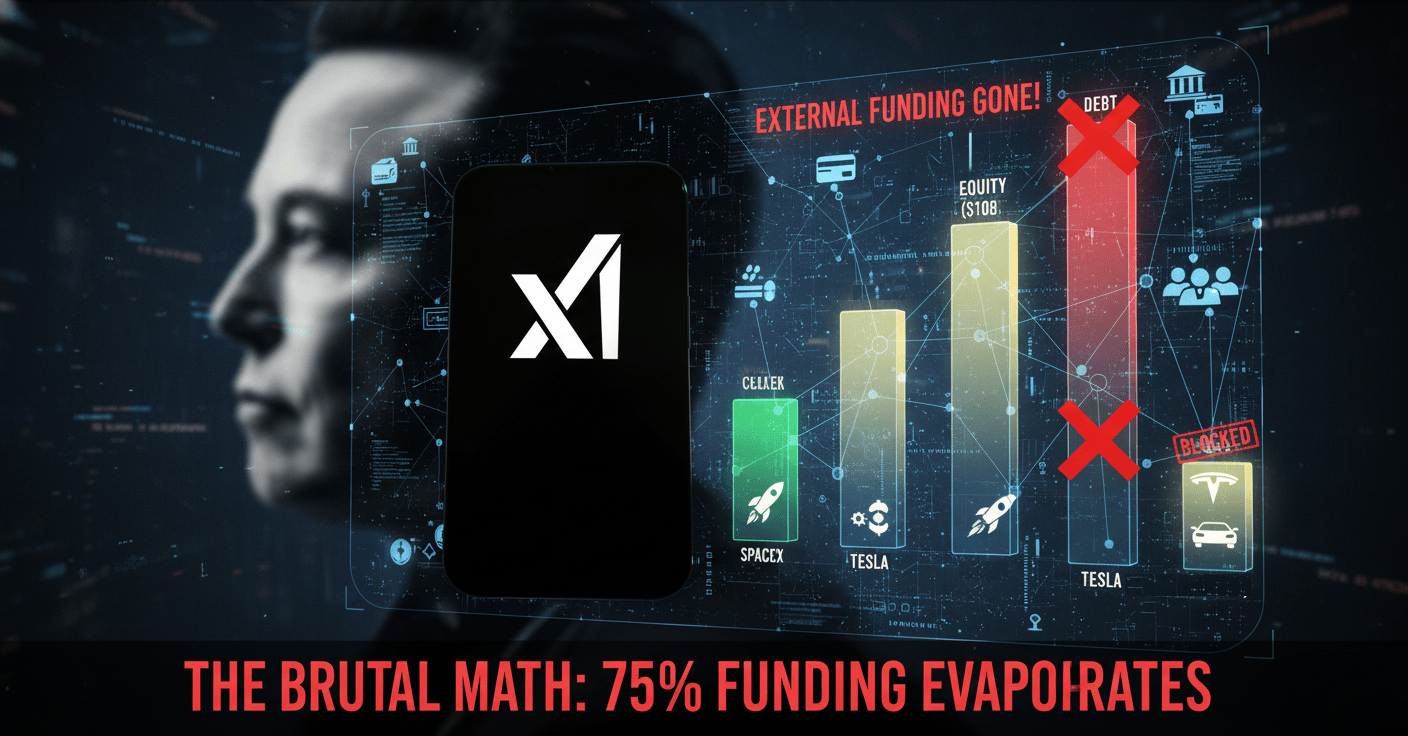

Now, let's "follow the money". It's a critical exercise. Where is xAI's cash coming from? It's not all from Elon. Based on public reports, the funding structure looks something like this:

~$10 billion was raised through equity (selling shares to outside investors).

~$12 billion is currently being raised through debt (loans).

~$2 billion is coming from SpaceX (another of Musk's companies, which we'll get to).

~$5 billion is potentially coming from Tesla (Musk is trying to get Tesla to fund it but shareholders are actively moving to block this).

3. The Brutal Math

Let's do the simple math here. Only about 25% of this massive funding pool comes directly from Musk. A staggering 75% comes from debt and external equity investors. These are people and funds who expect a return on their investment. They are not giving him this money out of the goodness of their hearts.

When the bubble bursts and the capital market freezes (as we established in Part I), all of that external funding disappears. The loans will be called in. The equity investors will have no more money to give. xAI's burn rate is massive and its business model is non-existent. Musk would need to quadruple his internal funding just to maintain current operations and he won't have the cash to do it.

4. The Twitter (X) Anchor

To make matters worse, xAI is financially tied to Twitter (X). Because xAI effectively bought Twitter and Twitter is not profitable, the social platform will collapse right alongside xAI when the cash flow stops. Musk simply cannot afford to prop up both failing, cash-burning companies on his own.

5. The Inevitable End

When that external funding disappears, xAI faces immediate bankruptcy or dissolution. There is no "Plan B" when your entire business model depends on speculative investment that suddenly ceases to exist when the AI bubble bursts.

III. Tesla: The AI Mirage Meets Cold, Hard Reality

Okay, so xAI is a goner. But what about Tesla? Tesla is the fortress, right? It appears to be completely different. Its AI projects (Full Self-Driving (FSD), Robotaxis, the Optimus robot) are all internally funded by car sales profits. With AI expenditure ballooning past $11 billion annually, Tesla can theoretically handle these losses because it's not dependent on external capital like OpenAI or xAI. This is the argument everyone makes for why Tesla is safe.

But this view completely misses the real, hidden threat. The threat to Tesla isn't its spending; it's its valuation. The danger comes from two places: market revaluation and collapsing profits.

1. The Valuation Fantasy: Is Tesla an AI Company?

For years, investors have not valued Tesla as a car company. They've valued it as a high-growth AI company, thanks almost entirely to the promise of its self-driving ambitions. This "AI premium" is the only explanation for Tesla's huge valuation, which has dwarfed traditional car manufacturers that sell more cars and make more profit, like Toyota or Ford.

So, what happens when the AI bubble bursts? The market, in its panic, will recognize AI's broken promises. "Hope" will be replaced by "profit". Tesla's "AI premium" will instantly drop to approximately zero. The market will suddenly revalue Tesla for what it actually is: a car company.

2. The Math of Destruction: What's a Car Company Worth?

Let's do the simple math on what that revaluation looks like. A typical, profitable, mature automaker like Toyota trades at a Price-to-Earnings (P/E) ratio of around 8.2. This means its stock value is about 8.2 times its annual profit. This is a standard, sane valuation for a manufacturing company.

Now let's look at Tesla. Its 2025 projected profit is around $15.2 billion (which is actually down 20% from 2024, a bad sign).

So, what happens if we apply Toyota's sane P/E ratio of 8.2 to Tesla's $15.2 billion profit?

$15.2 Billion (Profit) x 8.2 (P/E Ratio) = **$126.64 Billion**

That number, $126.64 billion, is Tesla's post-bubble valuation. This is less than 10% of its value at its peak. It just becomes another car company and not even the biggest one.

3. The Profit Death Spiral

This revaluation is made even worse by the fact that Tesla's core profits are set to continue falling. Musk is forcing the company to pivot away from EV development and towards AI.

Meanwhile, competitors (especially from China) are leapfrogging Tesla with better, cheaper EVs. This means each quarter could bring lower profitability, which would accelerate Tesla's stock decline even further.

4. The Hidden Killer: Musk's Personal Debt

This is where the house of cards truly collapses. This is the "holy shit" moment that most analysts are ignoring. This is the part that could be a personal catastrophe for Musk, not just a corporate one. He has used over half his Tesla shares as collateral for massive personal loans; loans that funded his purchases of xAI, Twitter and even SpaceX operations.

Let's look at the estimated numbers from public filings:

Musk's Tesla Stake: ~15.73%

Shares Used as Collateral: ~7.8% (about half his total stake)

Average Tesla Valuation When Loans Secured: ~$1.2 Trillion

Estimated Total Loans Backed by Shares: ~$94 Billion

Musk borrowed nearly $100 billion, using his high-flying $1.2 trillion Tesla stock as collateral. A “sure thing.” But what happens when that collateral's value disappears?

5. The Margin Call Apocalypse

Let's play out the scenario. The AI bubble pops. Tesla gets revalued as a car company and its stock crashes to $126.64 billion.

Now, let's look at Musk's loans:

His 7.8% collateral stake is suddenly worth only $9.88 billion.

His total 15.73% stake in the entire company is only worth about $19.9 billion.

This is the margin call. The lenders (a syndicate of banks) who loaned him $94 billion will panic. Their $94B loan is now backed by collateral worth less than $10B. They will issue margin calls, demanding immediate, full repayment of the $94 billion.

Musk doesn't have $94 billion in cash. Even if he sells his entire $19.9 billion stake in Tesla, it wouldn't be enough to cover the debt. He would be personally bankrupt.

6. The Financial Prison

You might be thinking, "Why doesn't he just sell his shares now, before the AI bubble bursts?" He can't. He's completely locked in. If he tried to sell half his shares ($94B worth) to clear his debt, the sheer volume of that sale would instantly crash Tesla's stock by itself, triggering the very margin calls he's trying to avoid.

He is in a financial prison of his own making.

7. The Inevitable Outcome

When the bubble pops, Musk will be forced to liquidate his entire Tesla position to try and satisfy the lenders. He will lose all his shares, all his power and his role as CEO. If Tesla survives the AI bubble, it will be as a much smaller car company and it will not be under his control.

Creating quality AI content takes serious research time ☕️ Your coffee fund helps me read whitepapers, test new tools and interview experts so you get the real story. Skip the fluff - get insights that help you understand what's actually happening in AI. Support quality over quantity here!

IV. SpaceX: How the AI Crash Kills a Rocket Company

"Okay", you might be thinking, "so xAI is a goner and Tesla is a catastrophe. But what about SpaceX? SpaceX is the crown jewel. It's a real, physical rocket company, not a speculative AI venture. It should be totally safe from all of this, right?"

I'm afraid not. The AI bubble's collapse will likely destroy SpaceX through an indirect but absolutely deadly mechanism: the capital market freeze.

1. A Lesson from History

We have to use pattern recognition. What happened after the dot-com bubble burst in 2001? What about the 2008 financial crash? In both cases, equity and debt financing markets contracted massively. Investors who had been burned to a crisp refused to fund anything speculative. They would only invest where returns were practically guaranteed. All "moonshot" funding (pun intended) disappeared.

The AI bubble's collapse will create this same contraction but I believe it will be worse. Why? Because, as I explained, it will likely combine the dot-com bubble (a tech stock massacre) with the 2008 crash (a massive debt crisis).

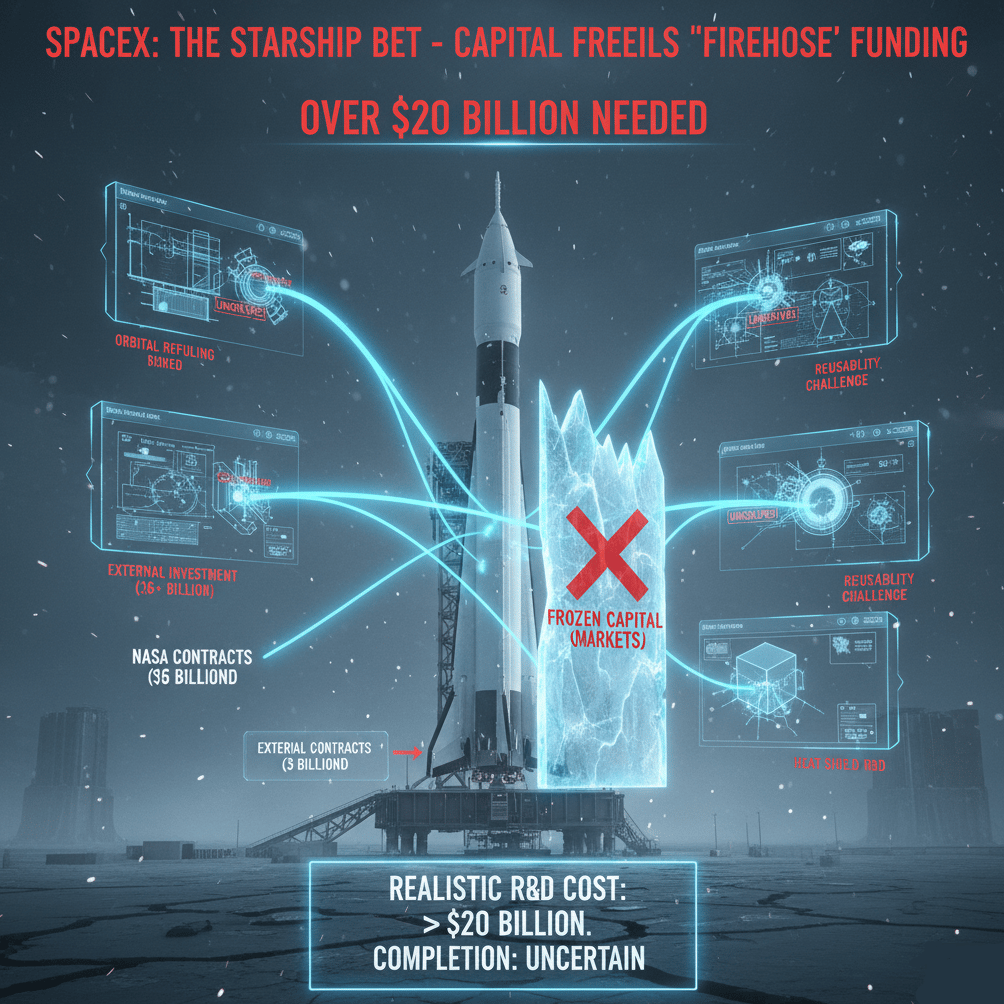

2. Starship: The Multi-Billion Dollar Money Pit

This capital freeze kills SpaceX because of one project: Starship. Starship is a "bet the company" moonshot. It's an incredible engineering feat but it requires an endless firehose of speculative investment for a product that is nowhere near complete and may never work as promised.

Let's look at the costs:

Development Costs: SpaceX had already spent $5 billion by 2023. With all the unplanned variants and additional launches, it's likely well over $10 billion by now. NASA has only provided about $4 billion of that. The rest came from investors.

Future Needs: The hardest parts are still unsolved. Critical engineering challenges like orbital refueling, landing and reusing the upper stages and creating rapidly reusable heat shields are still new. The project is far from complete.

Realistic Total Cost: The true R&D cost to get Starship to a fully reusable, operational state is likely over $20 billion, if it's even technically possible.

3. The Squeeze: Profits vs. Costs

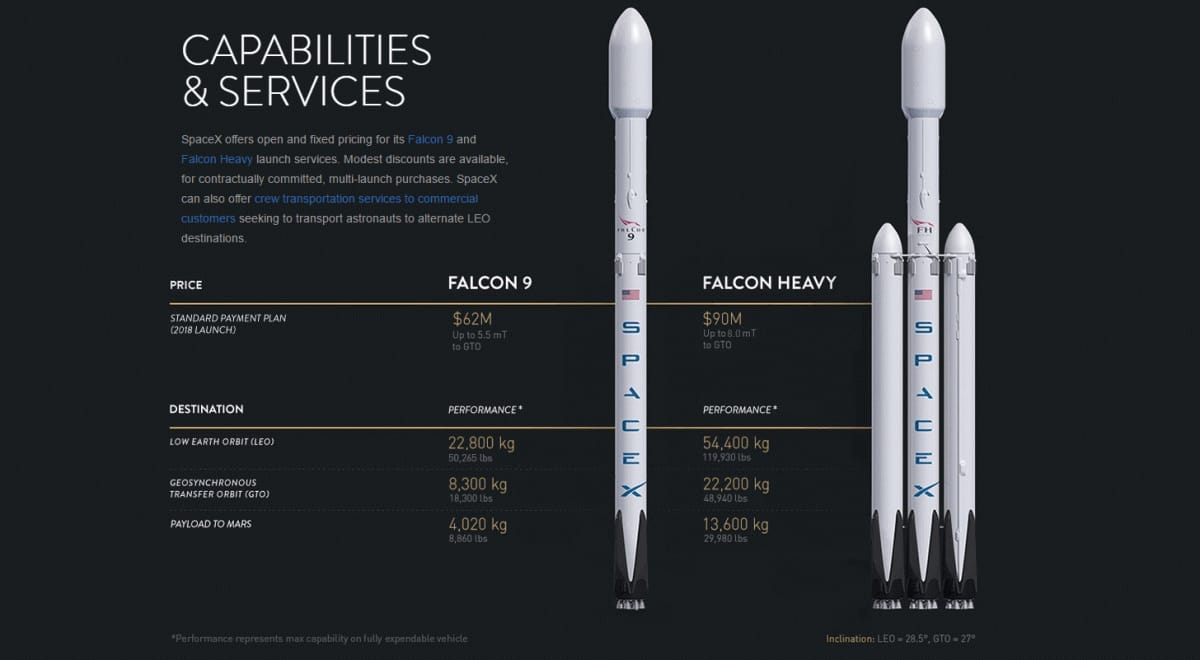

SpaceX's total lifetime funding from investors is around $12 billion. Its 2024 profit was reportedly just $147 million. Starship needs billions in new funding annually, for the foreseeable future.

So, I ask you: after the AI bubble bursts and the entire financial system freezes, who is going to give Musk billions of dollars for a purely speculative rocket that has zero guarantee of ever functioning as promised? The speculative money will be gone.

4. The Starlink Domino Effect

This is the final domino. Without continued funding for Starship, the Starship program will halt. And if Starship halts, Starlink dies.

Starlink, the satellite internet service, is unprofitable. Its entire business model was based on the assumption of Starship's mythical $10 million launch price. The current Falcon 9 and Falcon Heavy rockets are far too expensive to launch the next generation of Starlink satellites profitably. The math just doesn't work.

5. SpaceX's Business Disappears

This is a critical fact: in 2024, 70% of all SpaceX launches were for their own Starlink satellites. If Starlink stops, 70% of SpaceX's launch business disappears overnight.

SpaceX is then left in a deadly squeeze: it loses its primary business (Starlink), its remaining 30% of the launch market is stagnant and not growing and it somehow has to repay the billions in debt it took on from investors to fund a Starship program that will never generate a return. The company's value would plummet.

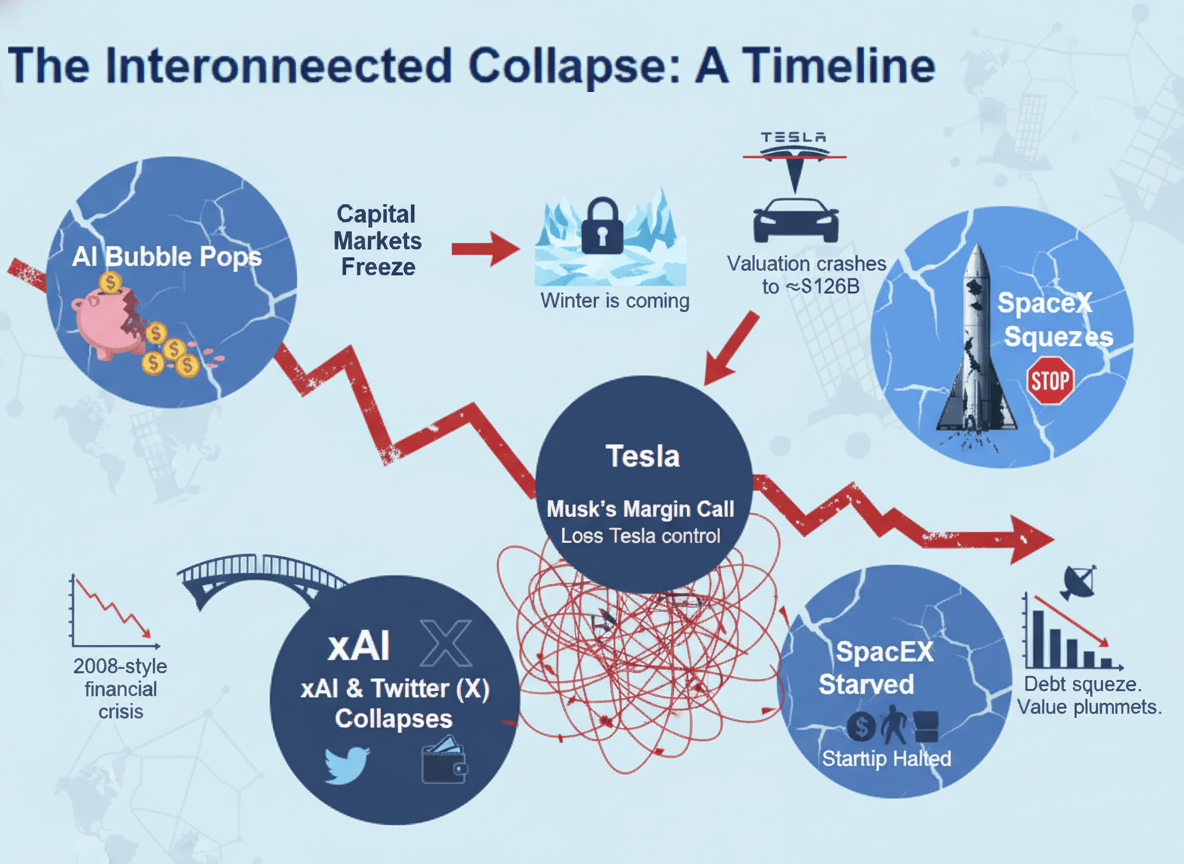

V. The Interconnected Collapse: A Timeline

What makes this scenario so particularly dangerous is how Musk's ventures are all tied together. It's a house of cards where each card leans on another. When one piece fails, it triggers a system-wide collapse.

Let's trace the likely sequence of events:

Phase 1: The Bubble Pops

AI company values crash.

AAA-rated AI debt defaults trigger a financial crisis.

Markets enter a recession.

Phase 2: Capital Markets Freeze

Venture capital disappears.

Institutional investment adopts extreme risk aversion.

Debt financing becomes prohibitively expensive.

Phase 3: xAI Collapses

External funding disappears.

Musk can't quadruple internal funding.

xAI and Twitter both go bankrupt.

Phase 4: Tesla Revaluation

Market removes AI premium from Tesla.

Stock crashes to ~$126B valuation.

Musk’s margin calls are triggered.

Phase 5: Musk's Forced Exit

Must liquidate his entire Tesla position.

Loses control and CEO role.

Tesla potentially survives without him.

Phase 6: SpaceX Starved

Can't raise Starship development funds.

Starship program halts.

Starlink becomes unsustainable.

70% of business disappears.

Phase 7: SpaceX Squeeze

Remaining 30% of business insufficient.

Can't repay Starship investments.

Company value plummets.

Conclusion: The Real Vulnerability

The conventional wisdom that Elon Musk is safe from the AI bubble is wrong. This analysis, based on public data, reveals his entire empire (Tesla, xAI and SpaceX) is fatally vulnerable to the bubble bursting.

His companies are not isolated fortresses; they are a financial house of cards. The entire structure is propped up by massive personal debt (backed by volatile Tesla stock) and a web of interconnected dependencies.

When the bubble pops, the speculative funding that fuels xAI and Starship will disappear. This capital freeze will trigger a chain reaction, starting with a Tesla stock crash and a massive margin call on Musk's personal loans, which could lead to a total collapse of the entire empire.

The AI bubble’s collapse won’t just affect AI companies. The interconnected nature of modern finance and the huge size of this speculative debt mean the bubble's burst will have far-reaching consequences beyond the obvious targets.

The AI bubble isn't just about AI. It's about what happens when an ecosystem built on cheap, speculative money finally faces reality.

If you are interested in other topics and how AI is transforming different aspects of our lives or even in making money using AI with more detailed, step-by-step guidance, you can find our other articles here:

What do you think about the AI Report series? |

Reply